In the current experience economy, many C-suites are finally paying attention to user experience. There is an effort on the way to use UX research to support good business decisions related to product development and marketing strategies to support customer acquisition and retention. However, many put in charge have no training in research, and there is a lot of confusion about UX among business leaders, market researchers, and UX practitioners.

In this webinar organized by ESOMAR, MRII at The University of Georgia, and CRIC, Michaela Mora, president of Relevant Insights, discusses what is and what is not UX, how research can support UX, and the areas of expertise needed to conduct UX research.

What Is UX?

UX stands for user experience. User experience is really a state of mind combining emotions and attitudes that develop as a result of user interactions with products and services with customer support and even marketing which helps to set expectations about the user experience. The term user experience started being used in 1993 at Apple when they realized that the experience of using Apple computers was weak. You may probably may have also heard the term CX, which stands for customer experience.

Depending on the organization structure and who does different types of research, the terms “user experience” and “customer experience” may be used interchangeably or kept separate to represent different areas.

UX often is mainly about product experience based on interactions while CX is connected to customer satisfaction with customer service and the brand and products in general without getting too deep into product interactions. Some companies make the distinction based on the acquisition state. For example, the term “user” may be applied to prospect customers when they visit a website but have no purchase yet and the term “customer” is used for those who have already purchased something so the definitions vary depending on how organizations are structured and how they define customers.

However, we could consider that the research done under each term as efforts to understand users along the journey from prospects to customers. We are looking at user interactions at different touchpoints in that journey.

UX Touchpoints

The user experience field has been growing mainly in the area of product development to learn about how users interact with products and the problems they face in order to make improvements, but the user experience is not limited to product use. The key UX touchpoints in this process include:

- Product Development

- Pre-Sale

- Point of Sale

- Post-Sale

In every step of the journey since you announced the product is coming, to the moment of purchase, to the actual product usage, there are interactions that will have a positive or negative impact on the total user experience. This is why for example even poor product quality can be forgiven if customer support interactions exceed expectations.

So, the study of user experience should include not only the early interactions with prototypes during product development but also the experience with different marketing channels when we are trying to identify new customers and set expectations about new products. It should include the actual purchase experience at the point of sale since a bad shopping experience may lead to abandonment or damage to brand reputation particularly if the brand sells directly to users. Finally, it should include the post-purchase experience to understand how people use products in real conditions to be able to improve them.

In this phase, we also need to use research to guide improvements in the experience with customer support and marketing campaigns to keep customers engaged and encourage repeat purchase.

What Is NOT UX?

Usability

Because user experience has been of special interest to developers of digital products like software, apps, websites, the term is often interchangeably used with usability. Usability is a contributing factor to user experience but does not explain the full user experience. Usability is a quality attribute, which is aimed at creating ease of use. The technical definition of usability includes:

- Learnability – How easy is for you to do basic tasks the first time.

- Efficiency – How quickly can you perform tasks once you learn how to do it.

- Memorability – How easy can you become proficient again when you stop using the product for a while and start using it again.

- Errors – How many errors do you make, how severe are those errors, how easily can you recover from them.

- Satisfaction – Was this a pleasant experience? When products are easy to use, they tend to create some level of satisfaction. The thing is that we are more likely to notice products when they are difficult to use because of the frustration they cause.

Utility

Another contributing factor to user experience is utility. This has to do with product functionality and the ability of the product to provide benefits and satisfy a need. Again, utility is not the same as user experience. When we combine usability and utility, we can have different user experiences. Ideally, you want products and services that are easy to use and meet and need, but we all have seen products that are easy to use but are not relevant to us, we don’t need them, and products that we really need but are difficult to use. In both cases, we are likely to have a bad user experience.

Visual Design

The visual or physical design of products has also an impact on the user experience but again it’s not the same. Visual design is about surface design, colors, layout, shapes, texture, content density, feature density, but a beautiful design can be irrelevant or difficult to use or both, so we cannot rely only on surface design to create good user interactions. In short, user experience is NOT usability, utility, or surface design.

The State of UX Research Experience

A 2019 study from usertesting.com about trends in the customer experience field asked over 1,600 professionals across a variety of industries how the organizations were approaching customer experience and conducting CX research. The study found that many designers don’t have access to research, and many researchers are struggling to do quality work at the rapid pace of product development. At the same time an overwhelming majority of executives, 86 percent was in favor of scaling up user research.

The challenge usually lies in the level of UX maturity many companies have which is strongly associated with the priorities of the business and having people qualified and knowledgeable about research fundamentals.

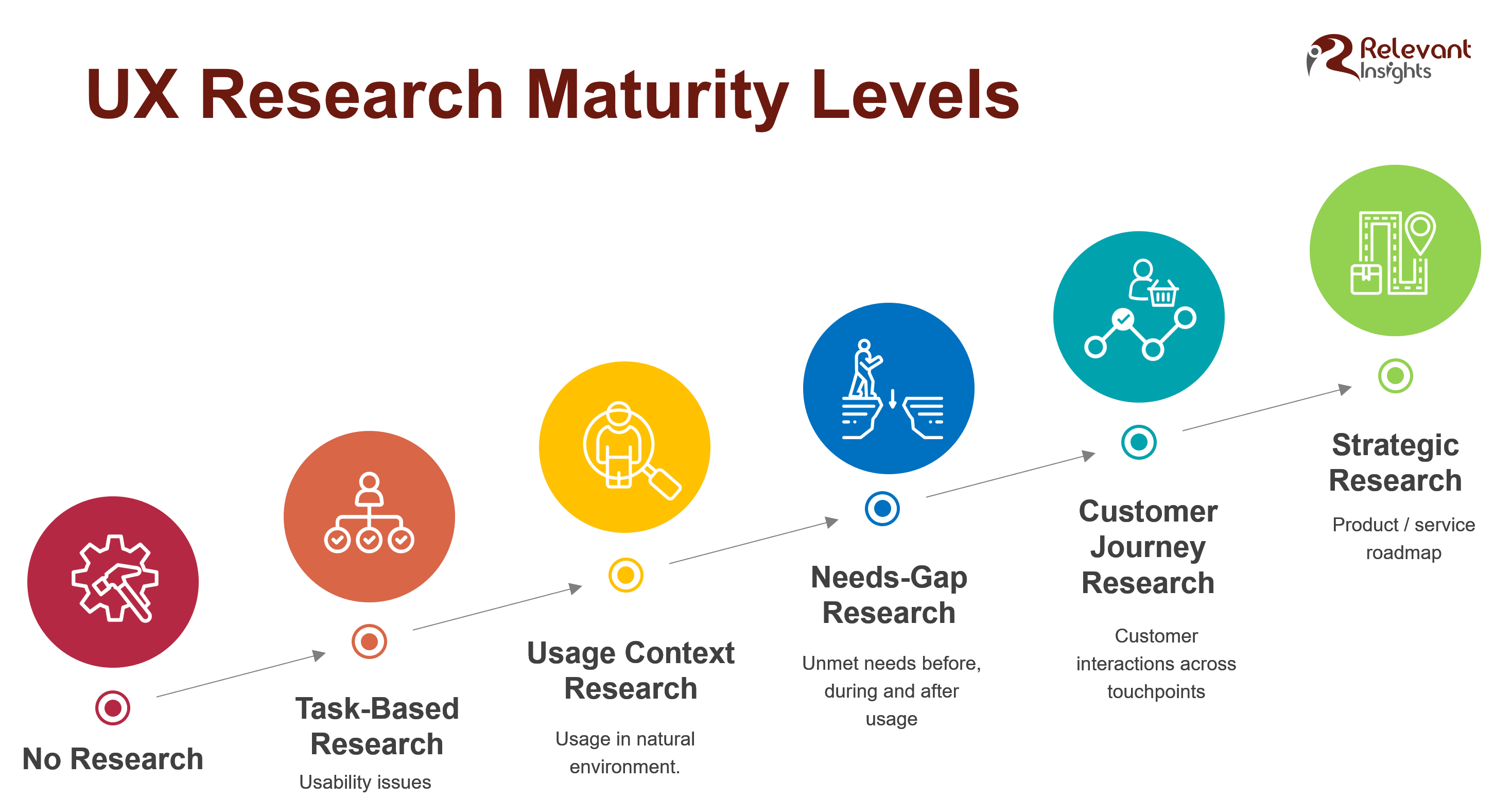

UX Research Maturity Levels

There are several models of UX maturity levels out there. Here it is one that is practical and actionable

Level 1 – Lack of Research The company is often focused on products, technology, and growing the business. Often in the C-suite, the level of awareness about the value of doing research is low or doesn’t exist. There’s a lot of gut feeling driving product development, marketing, and business decisions.

Level 1 – Lack of Research The company is often focused on products, technology, and growing the business. Often in the C-suite, the level of awareness about the value of doing research is low or doesn’t exist. There’s a lot of gut feeling driving product development, marketing, and business decisions.

Level 2 – Task-Based Research There is some awareness about user research mostly to find usability issues or improve visual design. This level is dominated by task-based usability testing. The tasks may come from what the designers or my product managers imagine the users may do, from support tickets or customer service feedback from customers, or from actual user interviews which is the more advanced expression of this level.

Level 3 – Usage Context Research When they move to the next level, the team starts doing field studies where they observe users in their natural environment. In this case, contextual inquiry is the most common research method which combines ethnographic research and user interviews on-site.

Level 4 – Needs-Gap Research The next level in maturity where research gets, it gets really focused on understanding the needs of the users before during, and after using a product or service. This is where we look for unmet needs or gaps in the experience to be able to really create good user experiences. The research here allows companies to start creating metrics of success for the user experience and the business.

Level 5 – Customer Journey Research The research of needs often takes the team to the next level of maturity trying to understand the customer journey across all the different touchpoints of the user experience over time. Here we look not only at new customers but also at repeat customers and study how their user experience evolves in a longitudinal way. At this level, the teams get really serious about establishing metrics of success and track them over time.

Level 6 – Strategic Research Finally, the companies that become really customer-centric and realize the value of research invest in hiring trained researchers and give them the resources and time needed to conduct strategic research in order to develop long-term product roadmaps and marketing strategies to make them successful.

In terms of methodology, each level up includes methods used in lower levels. They don’t become exclusive. Each higher-level just keeps adding tools and scope as the UX function matures. At the highest level of maturity, there is a place for both strategic research and tactical research for specific goals.

This discussion about UX maturity is happening mainly in the context of digital product development, e-commerce, digital marketing. It seems that digital-first and tech companies are discovering now what consumer packaged goods companies, CPG companies, discovered a long time ago with the help of market research, which is a field that is nearly 100 years old. However, we are seeing a lot of unneeded reinvention because those who are starting to do research without training or guidance from professionals don’t know there is already a big research toolbox available in the marketing research field.

This is also one of the reasons UX research maturity is low in many companies. Companies hiring for these positions are prioritizing design and development skills without realizing that what they need are UX researchers with training in research first.

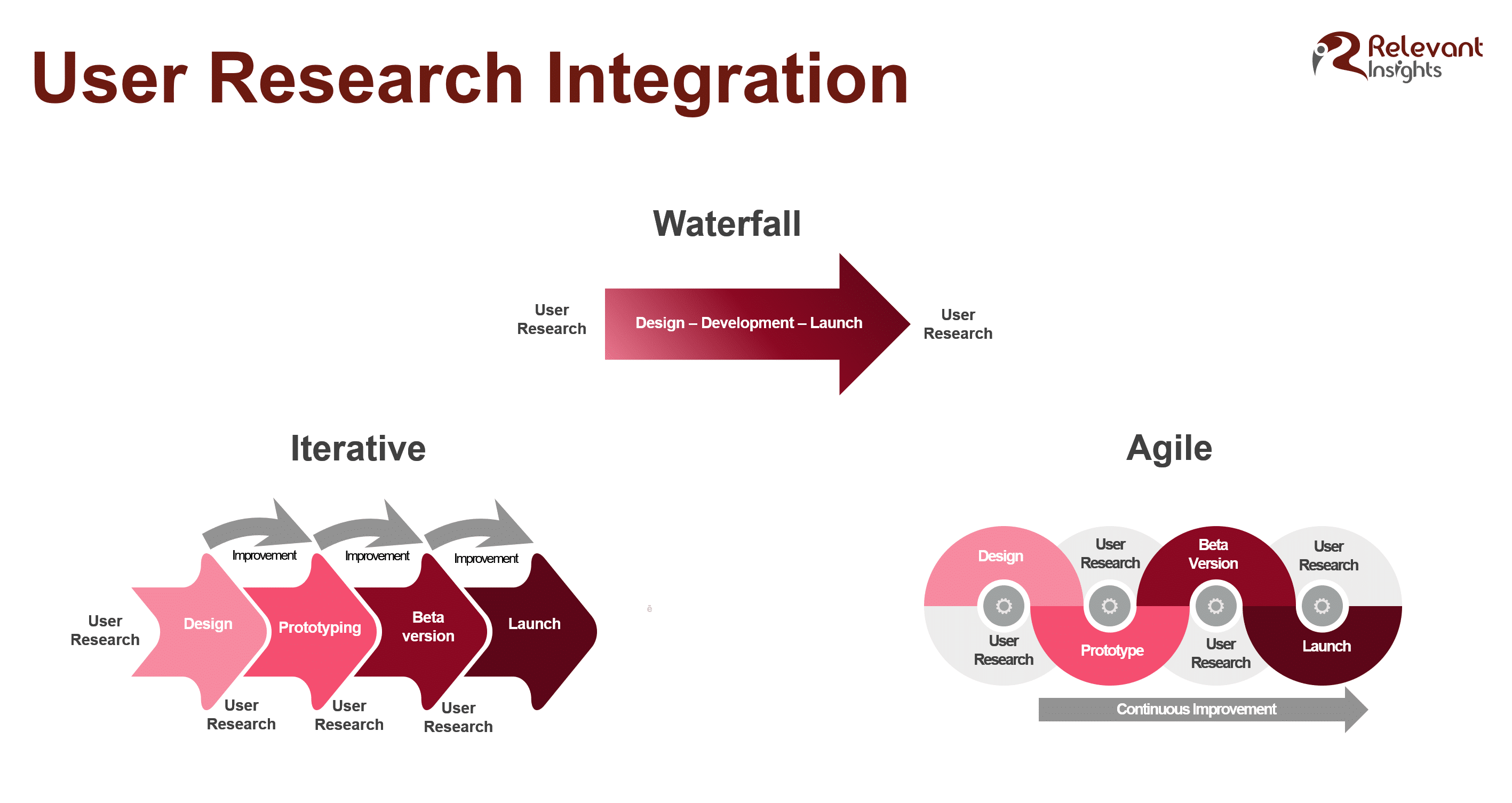

UX Research Integration

There are different approaches to product development and how research can be integrated with them.

- Waterfall Product Development In this approach companies may start with user research to understand their needs or identify segments and then proceed to design development and launch, and after launching the product then they may look at users’ reactions to the final product.This is how product research has been traditionally done by many CPG companies as part of their marketing and R&D processes.

- Iterative Product Development In the Iterative approach, user research is integrated to provide insights at different steps of the process to make incremental improvement. Here there is a pause to conduct research between each step so many companies use this approach, but it very much depends on budget and timelines.

- Agile Product Development Finally, there is the Agile approach, in which user research is happening at the same time as the different product development stages continue. The focus tends to be narrower on fewer issues and is mostly based on qualitative research. There’s no pausing. All is happening at the same time and insights are integrated on the fly. The rapid movement in this approach is requiring non-researchers like product managers and designers and developers to act as researchers without having the training in research. This really requires good coordination with the product development process and without training in research, the quality of insights is often lacking.

Another problem is that it’s very hard to be objective about your own designs and products. Being the creator of something makes you partial to it and a victim of confirmation bias.Designers, product managers, and developers need help from neutral research partners to minimize biases in data collection and interpretation of results. Again, this represents a big opportunity for people with a research background.

Research Maturity & Integration

The good news is that these research approaches can coexist depending on the research maturity level in the organization.

For example, the Iterative approach can be used at any level of UX maturity, if that works for the product development process in terms of timing, budget, and availability of researchers.

The waterfall approach which may start with user research, consumer research. This is how many companies, CPG companies, use market research for product development, branding, and advertising. It helps them understand needs, customer journeys, and make more strategic research related to brands, market segmentation, and brand positioning and pricing.

The Agile approach, which goes well with qualitative usability testing and user interviews, can help uncover usability issues, understand needs, and do quick dives into specific points of the customer journey, but it’s less useful when it comes to do research of strategic nature.

Again, companies can combine these approaches for different purposes. They don’t have to adopt only one. They just need to hire researchers and research vendors who can support them.

Market Research vs. UX Research

Market research and UX practitioners are missing each other and are unaware of the overlapping research subjects. In the product development process, going from product idea, identification of benefits, marketing, and product usage, the commonalities between both become more obvious just by looking at some of the research techniques used.

UX research methods are really adaptations of techniques we have been using in market research for a long time. When companies have both a consumer insights team and a UX team, the type of research they do tend to differ in terms of strategic value.

Since UX researchers are often embedded in product teams and consumer insights often supports marketing and other strategic functions, their efforts may not be coordinated, and each group ends up doing their own thing without talking to each other.

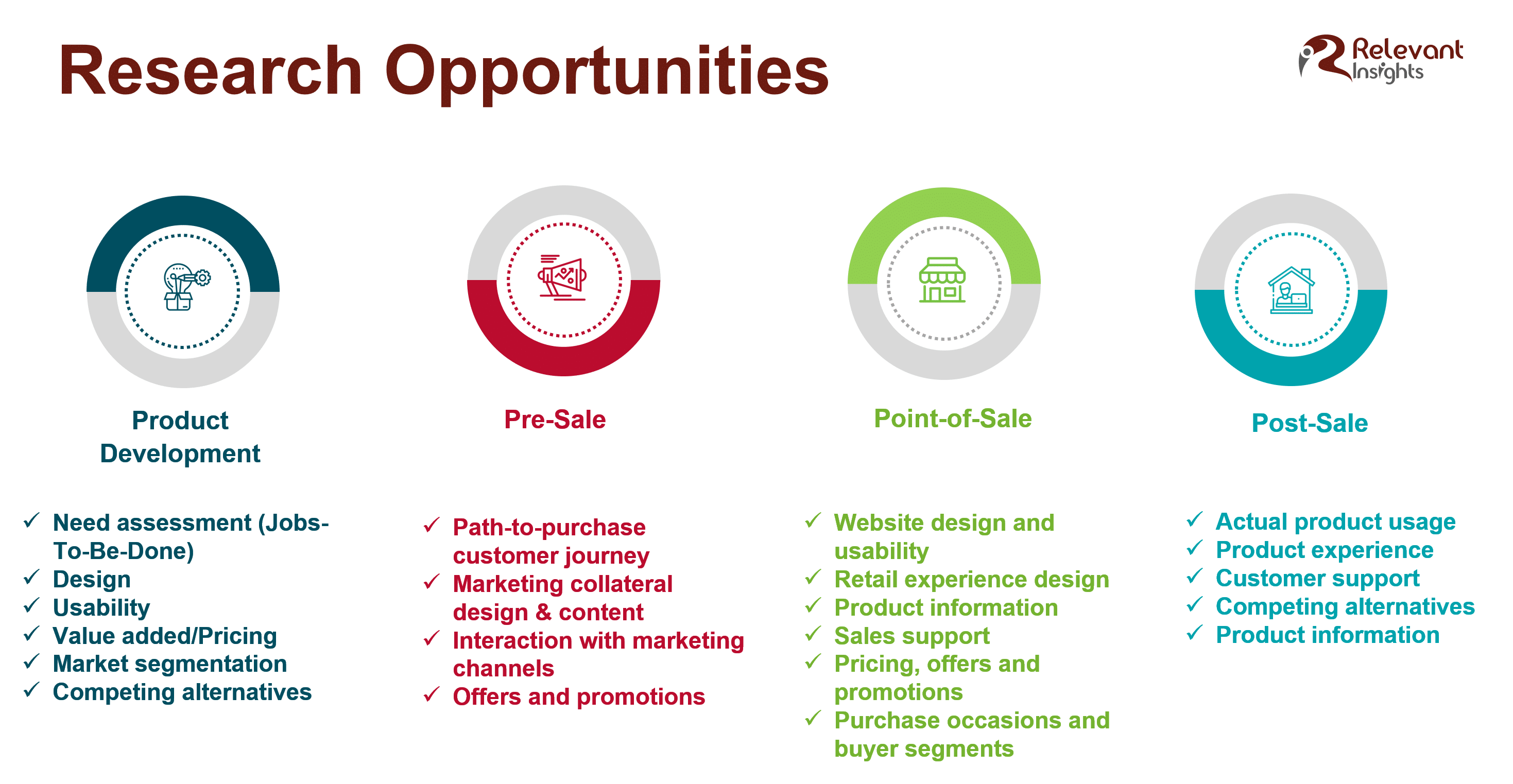

Research Opportunities

Based on the UX touchpoints where the user experience is created, there’s a lot of research opportunities of strategic and tactical value where both market research and UX research could complement each other.

Needed Areas of Expertise

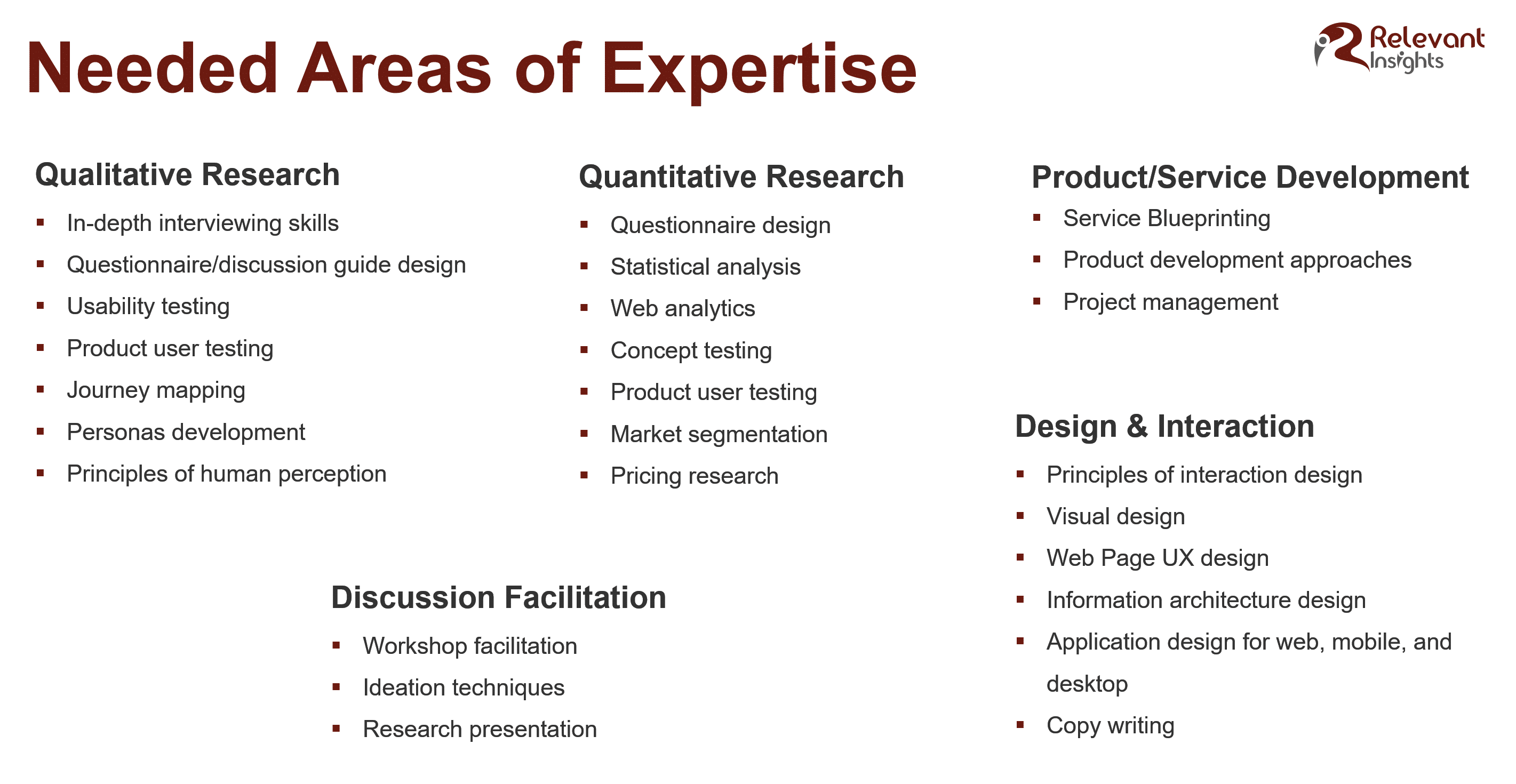

Companies are trying to strike a bargain and get a two for one or a three for one deal when it comes to UX talent. Over time, they will realize that trying to get someone to do everything tends to yield mediocre results, at best. However, each role involved in the UX process should at least be familiar with some key domain areas so they can find a common language and are able to collaborate in an effective way. Here are some topic areas that are relevant to conduct good user research.

For example, researchers would benefit from learning about principles of visual design and interaction design even if they don’t need to become designers or developers.

At the same time, designers, developers, product managers would benefit from learning some of the research fundamentals so they can contribute to the research design, participate as observers, and interpreters of results in a more effective way without having to become full-time researchers. If you have a team of people with expertise in one major area like research, design, development, project management, and who are also familiar with a couple of other areas from the same set, you are more likely to have a productive team that can work well together, produce quality work, and be less prone to burn out. Having a team of one, who tries to do everything is not sustainable in the long run. Aside from your current area of expertise, select a couple of other areas from this list and learn more about them.

At the same time, designers, developers, product managers would benefit from learning some of the research fundamentals so they can contribute to the research design, participate as observers, and interpreters of results in a more effective way without having to become full-time researchers. If you have a team of people with expertise in one major area like research, design, development, project management, and who are also familiar with a couple of other areas from the same set, you are more likely to have a productive team that can work well together, produce quality work, and be less prone to burn out. Having a team of one, who tries to do everything is not sustainable in the long run. Aside from your current area of expertise, select a couple of other areas from this list and learn more about them.

They may be needed in your organization. That will allow you to collaborate better, but don’t try to become a do-it-all.

UX Metrics

UX metrics should be unique for each organization. Companies want to differentiate your products and servers, being unique but many try to use universal metrics. That’s not helpful. We should think of three categories of metrics.

Metrics of Success

These measure the ultimate goal of improving someone’s life with our product or service. This is linked to main benefits your product or service delivers. It could be saving time, saving money, increasing convenience and efficiency for the user. You need to determine what the ultimate need your product is meeting and use that as a metric of success. If you are not meeting a need, the business won’t stay for long in business.

Metrics of Problems

The second metric category is metrics related to problems users run into that prevent them from meeting their needs, affect the user experiences, and have a direct impact on the business.This is your opportunity to attach a monetary value to show how much the problem is costing the company and why we need research to solve it. For example, testing whether product and price information on your website communicates the value users get may tell you the obstacles they find in understanding it and impact the decision to buy your products.

Again, this metric should be specific for your business and require internal agreement and refinement based on continuous research.

Metrics of Progress

Finally, the third category is related to metrics of progress, how are we progressing in eliminating those obstacles? and what is the impact on the business? You need to conduct research not only to figure out how to eliminate the obstacles but also how you track the results, you need to track the results from implementing the insights. If you establish a set of metrics that tracks monetary value based on the improvements resulting from research, you are likely to get buy-in from top management. During my time at Blockbuster, we kept improving the search function on the website, which was directly correlated with the volume of calls to customer service. The more calls, the higher the cost. We were able to triangulate results from user research and customer satisfaction tracking surveys and discover that inaccurate research results were pushing people to call more. We monitored the changes in the search algorithm as it was improved, and research was showing how the user experience improved and how the cost went down for customer service.

So, I recommend discussing internally what metrics would help to improve the user experience for your specific product and have a business impact, and those metrics will be useful in selling research to the top management.

About the Author

Michaela Mora has over 20 years of qualitative and quantitative research experience in both client and supplier roles across a variety of industries. She is currently the President of Relevant Insights, LLC (www.relevantinsights.com), a full-service market research agency located in North Texas. Michaela earned an MS in Marketing Research from The University of Texas at Arlington, an MS in Marketing, Advertising & PR from Stockholm University, and an MS in Psychology from Havana University.

She also holds an Insights Researcher Certification (IPC) from the Insights Association, and a UX Master Certification (UXMC) with specialties in User Research and Interaction Design from the Nielsen Norman Group.

https://www.linkedin.com/in/michaelamora/